NTPC is set to benefit from the recently announced, UDAY (Ujjwal Discom Assurance Yojna) initiative, a debt restructuring program for state-owned distribution power companies, says Moody's Investors Service.

NTPC is set to benefit from the recently announced, UDAY (Ujjwal Discom Assurance Yojna) initiative, a debt restructuring program for state-owned distribution power companies, says Moody's Investors Service.

''The improving coal environment and proposed debt reduction program should boost the ability of offtakers to buy electricity, which will in turn increase NTPC's utilization rates and incentive income,'' said Abhishek Tyagi, a Moody's vice president and senior analyst.

''The improving coal environment and proposed debt reduction program should boost the ability of offtakers to buy electricity, which will in turn increase NTPC's utilization rates and incentive income,'' said Abhishek Tyagi, a Moody's vice president and senior analyst.

Lower tariffs will in turn increase the offtakers' ability to buy electricity, and thereby lead to higher incentive income for NTPC. Similarly, the debt restructuring scheme aims to reduce the debt burden of state-owned distribution companies, thereby increasing their financial capacity to offtake power.

Moody's said, limited ability to offtake power has been a key driver of a widening gap between NTPC's plant availability and utilization rates in recent year. As such, the debt restructuring scheme, if successful, would boost the utilization rates of NTPC's plants and increase incentive income.

The government's announcement to sell a 5% minority stake in NTPC during the fiscal year ending March 2016 will not affect the level of government support available for NTPC, given its dominant position in India's power sector.

Specifically, NTPC contributes around 16% of India's conventional installed power generation capacity, and 25% of total power generation. In addition, about 90% of the power generated by NTPC is sold to state-government owned distribution companies, underlining its key importance to the sector.

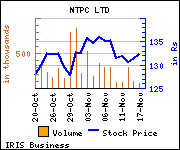

Shares of the company gained Rs 2.65, or 2%, to trade at Rs 134.85. The total volume of shares traded was 122,197 at the BSE (2.02 p.m., Wednesday).